I have been asked on more than one occasion over the past few weeks, “why is it taking longer to lease my vacant units?” Because of that, I want to use this edition of our Market Minute to examine the trends as they relate to asking rents and occupancy. Since we endeavor to bring you relevant market reports that take only a minute to read, we will cover south MS in this edition and south AL in the next edition.

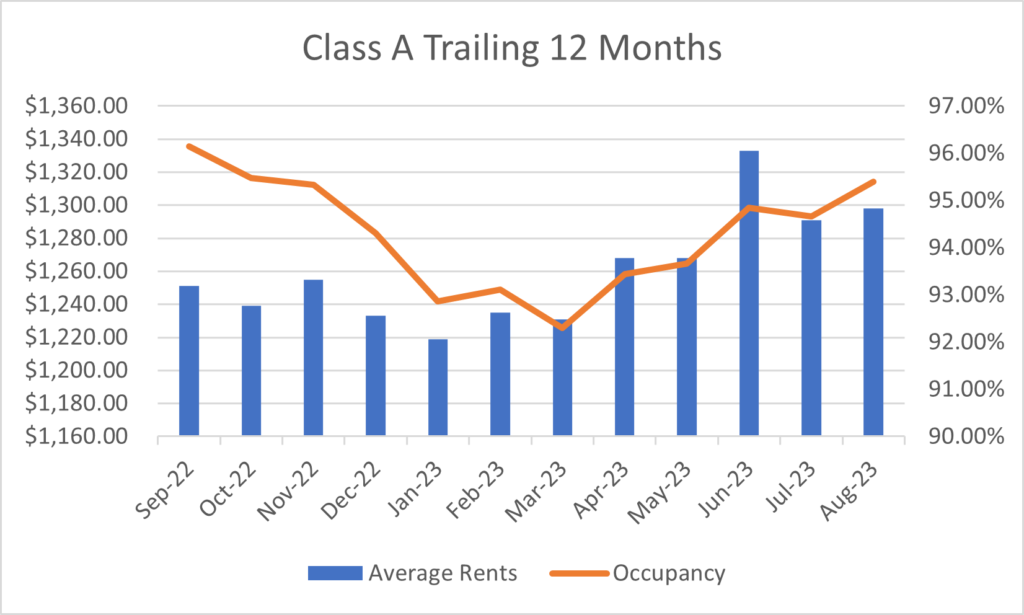

Class A rents, while up a modest 3.76% over the past 12 months, are up 6.48% this year so far. That is due to the fact that average rents fell slightly from November of last year to January of this year. Keep in mind that 4% annual increases are healthy and normal for the MS Gulf Coast. We have been spoiled with double digit increases for the previous 2 years.

A year ago, occupancy was 96.14%. Vacancies steadily increased for the 7 months from September, 2022 to March of this year until occupancy hit 92.3%. As a result, rents were flat for the most part during that period. Since March, occupancy rates have bounced back to 95.4% and we are seeing average rents across all units back to nearly $1,300 per month, $1,298 to be exact.

We potentially have 500 or more units in the pipeline coming on line in 2024. Consequently, you could see occupancy rates fall a few points and only moderate rent growth over the next 12 months.

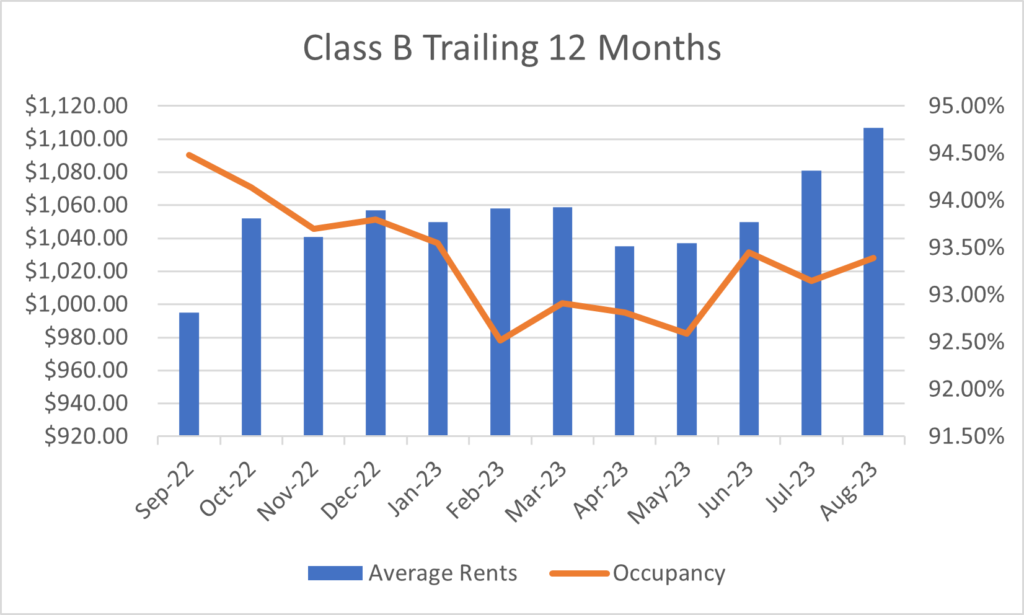

Class B rents are still up double digits for the trailing 12 months. From September of 2022 to August of this year we have seen 11.26% rent growth. Like the class A properties, we saw a decline in occupancy from September of last year to February of this year from 94.48% to 92.52%. While occupancy levels have only bounced back halfway to 93.39%, average rents have increased to $1,107 per month across all units. Even if occupancy rates continue the current trend upward, it is hard to imagine or predict continued rent growth above 10%. The class B units may be benefiting from the tightness of the class A market which, as mentioned above, has a decent number of units in the pipeline.

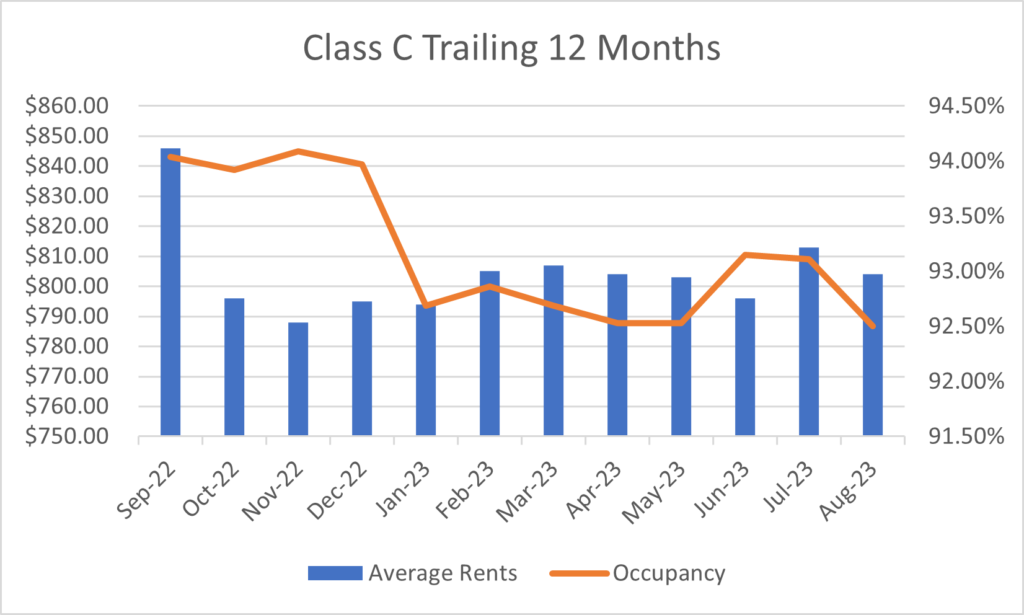

Rents for class C properties have declined by 4.96% since September of 2022. Occupancy rates remained steady through the end of last year and dropped from 94% to 92.69% in January of this year. Since then, occupancy rates have remained virtually unchanged at 92.5% and average rents are within a dollar of where they were in February. $804 as of August compared to $805 in February. It is interesting to note that the average rent dropped to current levels 3 or 4 months prior to the occupancy rate falling.

So, let’s answer the query, “Why is it taking longer to rent my vacant units?”

For class A owners, you are not even asking that question. There are only 6.7% more units available today than there were a year ago. You may have seen your waiting lists shrink and wait times get shorter, but you are getting them rented.

For class B and C owners. The answer is simply that there are 20% more class B units, and 26% more class C units, on the market today than there were last September. This is why it may be taking longer to rent your vacant units.

Like you, I love to learn. As you probably know, there are no good sources for reliable market data in our area. For markets like Atlanta or Houston, for example, CoStar, Real Capital Analytics and RealPage do an OK job. The best and most accurate market data I get comes from meeting and speaking with owners, investors, and property managers. I share that because I would love to hear your experience in the current market. Are you bucking the trends? Are you seeing anything different than what I am seeing? Please reply and share your thoughts.

Next edition we will focus on the trends in south Alabama. I will try to get that out in the next couple of weeks.

Thank you for taking the time to read this edition of our Multifamily Market Minute. We welcome your comments, questions, or future topic ideas. Feel free to forward this to anyone who you feel may be interested in this information. The Molyneaux Group exists to help real estate investors maximize their investment returns while minimizing their risk.